Register to get 1 free article

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

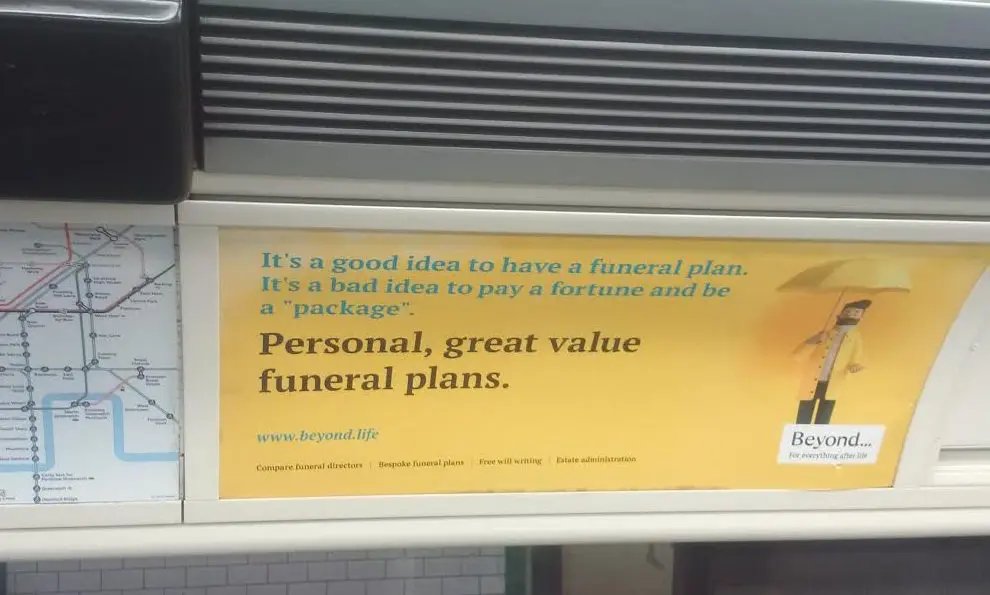

“So, these adverts are a tad edgier, and that’s deliberate,” said funeral comparison site Beyond in defence of a series of tube adverts which provoked a media storm. The adverts in question were disguised as adverts for other services and products such as holidays, medication, weddings and loans. TfL promptly banned Beyond’s entire campaign from its trains, buses and stations claiming they were “likely to cause serious and widespread offence” and told the company to “come up with a more acceptable campaign”. In banning the ads TfL consulted the Committee of Advertising Practice (CAP) who in turn told the travel company the ads would likely offend. Beyond hit back at the transport provider saying “TfL are happy to show adverts for loan sharks with cripplingly exploitative APRs, encouraging you to get yourself into debt, but our campaign, which could save you a fortune, is somehow deemed more offensive”. Beyond accused TfL of “killing the conversation” surrounding “talking about or engaging with death”. The funeral comparison website claimed that its adverts were aimed at engaging people with the subject and provoking conversation. Beyond’s co-founder Ian Strang said he was “hugely disappointed” with TfL’s response, adding that a lack of communication meant that companies were able to “take advantage of [the bereaved] when we’re in a weakened state”.

The Beyond adverts are not the first time that funeral professionals have found themselves in hot water over advertising. In April last year funeral plan providers Golden Charter were told off by the Advertising Standards Authority (ASA) for boasting about their offering, claiming in their advertising copy: “More people choose us for funeral plans over the Co-op” before going on to proclaim: “We are bigger than the Co-op”. Not content with claiming they were bigger than one of the profession’s biggest names, Golden Charter proudly claimed they were the “UK’s largest funeral plan provider”. Golden Charter’s bragging was soon brought to a halt however, despite the ASA agreeing with the funeral service provider that its claims could be substantiated, it said that it did not provide “sufficient information” to verify the comparative claims in its adverts. The ASA told the funeral plan provider that the ads “must not appear again in the form complained about”, telling Golden Charter to ensure they provided “sufficient information to enable consumers to verify comparative claims”. Golden Charter defended themselves by saying that the hyperlinked text in the Google advert took consumers to a landing page on their website where they could request an information pack, and said the information was based on analysis of statistics released by the Funeral Planning Authority (FPA). The funeral service provider believed that the FPA statistics were sufficient to appropriately signpost the information, to enable consumers to access the information themselves if they chose. Golden Charter said that the comparison in the TV ad was simple and justifiable and they believed it was therefore unnecessary to include clarification in the ad as to how the comparison could be verified. Despite the reference to FPA statistics, Golden Charter’s adverts were still found to be in breach of CAP code.

Shortly before Golden Charter, another funeral service provider fell foul of the advertising authorities rules and regulations, Promis Life funeral cover were reprimanded by the ASA in July that year for television adverts which featured on ITV4 and 5Star. The adverts played upon the rising costs of funerals claiming the average funeral cost £7,622, quoting the Sun Life Direct Cost of Dying Survey 2013 as its source. During the advert, a man said in direct address to camera: “Here’s a question for you. How much do you think a funeral costs? Well you might be shocked, as on top of the funeral director, hearse, coffin and other costs it can soon add up to well over £7,000”, while the figure was displayed at the bottom of the screen. The ASA received two complaints regarding the adverts who questioned whether the figure of £7,622 could be substantiated. In its defence the funeral service provider’s parent company, Global Life Distribution stated that the Funeral Protection Plan was a life insurance policy that paid out an agreed amount up to £20,000 upon death. It said that the policy was designed to provide a payment to be used to help fund all the immediate costs associated with a death, including basic funeral costs, additional costs commonly associated with a funeral, and additional costs of dealing with a deceased’s estate and legal matters. The company said that the ads did not specifically state that the average cost of a funeral was £7,622, adding that the figure represented other costs related to the funeral. They somewhat shadely stated that neither the script nor the on-screen text of either ad stated that the cost of £7,622 related specifically to the average cost of a funeral. The ASA acknowledged that while the advert did not specify what the £7,622 related to, they noted that the ads asked “How much do you think a funeral costs?” The authority considered that consumers would understand any specific costs listed following this question to relate to the cost of elements of a funeral rather than the general costs associated with a death. The ASA told Global Life Distribution that they must no longer show the advert and strictly told the company “not to mislead consumers by exaggerating the average cost of a funeral”.

With honest advertising mistakes happening regularly, along with somewhat more sinister attempts to deceive consumers as warned about by Beyond’s Strang, the ASA put together specialised guidelines for funeral service providers on advertising funeral services, creating adverts around the subject of death as well as one for independent operators on claims of independence or impartiality. The ASA says most of the issues it has faced relating to funeral service providers have focused on the advertisers’ descriptions of their businesses as independent, family-owned or family-run. It says these claims connote to consumers, that the advertiser can provide a personal touch or level of understanding that might be perceived as lacking from a large corporation. ASA guidelines state: “To be able to describe their business as independent, marketers should be able to demonstrate that they are legally separate from other funeral services or chains.” When describing this guideline, the ASA says that in 2005, a funeral home was told it could not be described as an independent business, because it was owned by a company that ran 43 other funeral homes. Just because a company may satisfy another organisation’s criteria for ‘independent’ does not mean they will satisfy the ASA’s criteria.

According to the ASA another common mistake made by funeral service providers is to claim they own a masonry service as opposed to offering the service via a third party. ASA guidelines state: “We understand it is common practice for funeral directors to provide advice and procurement of monumental masonry but marketers should avoid implying they have their own masons if that is not the case.” With the rise of eco-friendly funeral services, the ASA says marketers wishing to make environmental claims, should check they do not “over-claim”. The authority says two funeral companies have been found to breach the Code by making claims such as “environmentally friendly”.

When speaking of the broader topic of death in advertising the ASA says “no matter how sensitively it is handled, the topic of death nearly always generates complaints”, giving even more of a reason for funeral professionals to tread carefully when advertising their services. The biggest faux pas an advertiser can make with the topic of death appears to be within imagery according to the ASA. The authority says it is “difficult to judge accurately how the target audience will react to images of death”. It seems that with so many guidelines to tiptoe around especially with the sensitive nature of the funeral profession it is perhaps best to play it safe when advertising funeral services, however it seems Beyond must be commended for trying to break down taboos which allow dodgy dealers to benefit, even if they were deemed by some to be offensive.

This feature was first published in Funeral Service Times’ November 2018 issue